For the new year my plan is to open my daughter a brokerage acct. She's only 1 yrs old.

You probably don't want to open a brokerage account. If your daughter ends up college bound the money she has in that account will take away from any tuition assistance eligibility, If it looks like she has 15k, 30k, 60k or 90k in a stocks when she is 18 no one is looking to give her free grants. A way to get around this is to set up a retirement account for her; Specifically a ROTH IRA. Retirement accounts are seen as deferred accounts and thus don't count towards your assets for college or 99% of lawsuits. Also if she ever has to files for bankruptcy as a young adult (usually something like debt or being sued for an accident she caused) that money is protected.

The first 1.5 million, can't be taken, so she will be more than covered.

The thing about a ROTH IRA is she has to have income to start one, you cannot deposit more than your income, and the max contribution per year is 7k in 2024.

SO THIS WOULD BE MY PLAN IF I WERE YOU:

If you can, find a friend with a small business it could be something simple like MLM. The only requirement is they have to do taxes, note their business and itemize 1 or more of their business expense, because they will need to itemize this. They will be VERY happy to do this for you as it will look like they had less income then they actually had.

- take a picture of your daughter and put it on their website/app/or any other advertising. (take a screenshot/picture for your own records in case you are ever audited)

- Give them money, they then have to give that same money back to you (from their business account if they have it). There needs to be a memo/note with the money/check/cashiers check that says this is a payment for your daughter's (with her first name, middle initial, last name) for (business name) modeling. Again keep that note (take a screenshot/picture or save the paper for your own records in case you are ever audited)

- go to Vanguard or Fidelity and set up a free ROTH IRA in your daughter's name and SSN with that money

- Then use that money to invest. If she waits until retirement to take it out EVERY DIME of the money in the fund will be tax free.

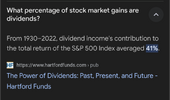

example: If you put $2,000 put into a Roth IRA, ONE TIME, at age of 1 years old, Then invest into a super low cost index fund like VTSAX or VOO it would be

$239,176 when she is age 62 if she got 8% return (this is a little conservative) or

$787,046 if she got a 10% return (this has been the average over the last 80 years for this fund). If she has any other income, in her future (like if she got a pt job in highschool) you and/or she can contribute more money into this account

this could would likely be a multiple of this amount when she was 62.

ONE MORE THING you will have to file taxes for your daughter the year of her "modeling" job. Those taxes should document the income she received. You have to do so to have everything on the level with the IRS. Then same a copy of those taxes, and the documentation above at least for the next 7 years.