You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Breaking News Stocks fall into correction, head for worst week since financial crisis

- Thread starter Mr.LV

- Start date

Mr.LV

OG

Markets

Fed Cuts Main Interest Rate to Near Zero, to Boost Assets by $700 Billion

By Rich Millet and Scott Lanman

March 15, 2020, 5:00 PM EDT

Jerome Powell Photographer: Andrew Harrer/Bloomberg

The Federal Reserve on Sunday cut its benchmark rate by a full percentage point to near zero and will boost its bond holdings by $700 billion to cushion the U.S. economy from the coronavirus outbreak.

The central bank also announced several other actions, including letting banks borrow from the discount window for as long as 90 days and reducing reserve requirement ratios to zero percent. The Fed, along with other major central banks, also lowered the rate on standing U.S. dollar liquidity swap arrangements by 25 basis points.

The Fed will keep interest rates near zero “until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals,” the Federal Open Market Committee said in a statement. “This action will help support economic activity, strong labor market conditions, and inflation returning to the Committee’s symmetric 2% objective.”

The moves follow a stock-market meltdown that has seen equity prices enter bear territory on investor fears of the mounting economic toll from the spreading coronavirus and what they see as the inadequate response from global policy makers, including the Trump administration.

It follows aggressive action by the Fed on Thursday to ease strains in the Treasury debt market through massive injections of liquidity and broader purchases of U.S. securities in a measure reminiscent of the quantitative easing it used during the financial crisis.

The Fed’s action also comes less than two weeks after it slashed rates by a half percentage point in an emergency move that failed to reassure nervous investors, in part because it was not accompanied by steps from other policy makers.

— With assistance by Jeff Kearns

Bloomberg - Are you a robot?

www.bloomberg.com

Fed Cuts Main Interest Rate to Near Zero, to Boost Assets by $700 Billion

By Rich Millet and Scott Lanman

March 15, 2020, 5:00 PM EDT

Jerome Powell Photographer: Andrew Harrer/Bloomberg

The Federal Reserve on Sunday cut its benchmark rate by a full percentage point to near zero and will boost its bond holdings by $700 billion to cushion the U.S. economy from the coronavirus outbreak.

The central bank also announced several other actions, including letting banks borrow from the discount window for as long as 90 days and reducing reserve requirement ratios to zero percent. The Fed, along with other major central banks, also lowered the rate on standing U.S. dollar liquidity swap arrangements by 25 basis points.

The Fed will keep interest rates near zero “until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals,” the Federal Open Market Committee said in a statement. “This action will help support economic activity, strong labor market conditions, and inflation returning to the Committee’s symmetric 2% objective.”

The moves follow a stock-market meltdown that has seen equity prices enter bear territory on investor fears of the mounting economic toll from the spreading coronavirus and what they see as the inadequate response from global policy makers, including the Trump administration.

It follows aggressive action by the Fed on Thursday to ease strains in the Treasury debt market through massive injections of liquidity and broader purchases of U.S. securities in a measure reminiscent of the quantitative easing it used during the financial crisis.

The Fed’s action also comes less than two weeks after it slashed rates by a half percentage point in an emergency move that failed to reassure nervous investors, in part because it was not accompanied by steps from other policy makers.

— With assistance by Jeff Kearns

DOS_patos

Unverified Legion of Trill member

let me find that healthcare etf real quick

Sion

Legion of Trill

StringerBell

OG

StringerBell

OG

Larry Kudlow Preaches Calm Amid Latest Dow Plunge

Director of the National Economic Council and President Donald Trump economic advisor Larry Kudlow preached calm to investors of the U.S. futures market during an interview with Fox Business host Stuart Varney, further encouraging investment in the markets - billing the most recent Dow plunge as...

SMH..

Mr.LV

OG

U.S. economy is now in recession, UCLA Anderson Forecast says

The coronavirus pandemic has already caused the recession to begin, the UCLA Anderson Forecast says in an unprecedented update.

U.S. economy is now in recession, UCLA Anderson Forecast says

Broadway in downtown Los Angeles in February.

(Al Seib / Los Angeles Times)

By LAURENCE DARMIENTOSTAFF WRITER

MARCH 16, 2020

11:03 AM

Show more sharing options

Forget predictions that the U.S. economy will enter a recession this year due to the coronavirus pandemic — the UCLA Anderson Forecast says it has happened already.

On Monday, the school revised a forecast it issued just last week that had stopped short of predicting a recession. The revised version says the economy has already stopped growing and will remain in recession through the end of September.

This is the first time in the 68-year history of the forecast that it has been updated before its planned quarterly update.

Economists at the the UCLA Anderson School of Management — the university’s graduate business school — said they revised the forecast after incorporating a review of how the 1957–58 H2N2 influenza pandemic affected the U.S. economy.

The year started solidly, but the forecast predicted that rapid effects of the virus slowed first-quarter economic growth to a rate of 0.4%, and that the economy will shrink at a 6.5% rate in the second quarter and shrink at a 1.9% rate in the third quarter.

Assuming the pandemic ends this summer and supply chains are restored, the forecast predicts the resumption of normal economic activity and an economic growth rate of 4% in the fourth quarter.

Because California has a higher proportion of its economic activity linked to tourism and trans-Pacific transportation, the forecast predicts that the recession will be slightly more severe in the state.

California is expected to shed more than 280,000 of its payroll jobs, with leisure, hospitality and transportation sector jobs accounting for more than one third of those. That would drive up the unemployment rate to 6.3% by the end of this year, with effects continuing into 2021, when the unemployment rate is expected to average 6.6%.

The forecast warned that its predictions could either be too pessimistic or too optimistic, depending on whether the coronavirus outbreak is worse than assumed or ends sooner than expected.

Sion

Legion of Trill

U.S. economy is now in recession, UCLA Anderson Forecast says

The coronavirus pandemic has already caused the recession to begin, the UCLA Anderson Forecast says in an unprecedented update.www.latimes.com

U.S. economy is now in recession, UCLA Anderson Forecast says

Broadway in downtown Los Angeles in February.

(Al Seib / Los Angeles Times)

By LAURENCE DARMIENTOSTAFF WRITER

MARCH 16, 2020

11:03 AM

Show more sharing options

Forget predictions that the U.S. economy will enter a recession this year due to the coronavirus pandemic — the UCLA Anderson Forecast says it has happened already.

On Monday, the school revised a forecast it issued just last week that had stopped short of predicting a recession. The revised version says the economy has already stopped growing and will remain in recession through the end of September.

This is the first time in the 68-year history of the forecast that it has been updated before its planned quarterly update.

Economists at the the UCLA Anderson School of Management — the university’s graduate business school — said they revised the forecast after incorporating a review of how the 1957–58 H2N2 influenza pandemic affected the U.S. economy.

The year started solidly, but the forecast predicted that rapid effects of the virus slowed first-quarter economic growth to a rate of 0.4%, and that the economy will shrink at a 6.5% rate in the second quarter and shrink at a 1.9% rate in the third quarter.

Assuming the pandemic ends this summer and supply chains are restored, the forecast predicts the resumption of normal economic activity and an economic growth rate of 4% in the fourth quarter.

Because California has a higher proportion of its economic activity linked to tourism and trans-Pacific transportation, the forecast predicts that the recession will be slightly more severe in the state.

California is expected to shed more than 280,000 of its payroll jobs, with leisure, hospitality and transportation sector jobs accounting for more than one third of those. That would drive up the unemployment rate to 6.3% by the end of this year, with effects continuing into 2021, when the unemployment rate is expected to average 6.6%.

The forecast warned that its predictions could either be too pessimistic or too optimistic, depending on whether the coronavirus outbreak is worse than assumed or ends sooner than expected.

This is BS, the US GDP growth for 2019 was 2.1% they haven't even posted US GDP growth for this quarter yet. They wouldn't know truthfully until end of June. Unless GDP groth for Q1 declines sharply to something exorbitant.

The article is also speculating. Title is click bait. Make no mistake I would love one for the prices it would create on stock markets all over.

IP360

Doctorate & Ph.D in Bootyology

Mr.LV

OG

March 16 stock market news

The stock market's roller coaster week continues as investors continue to worry about the coronavirus outbreak. Go here for the latest updates on the Dow, S&P 500, companies and more.

Dow and US stocks plunge again: March 16, 2020

By CNN Business

Updated 4:30 p.m. ET, March 16, 2020

What we're covering here today

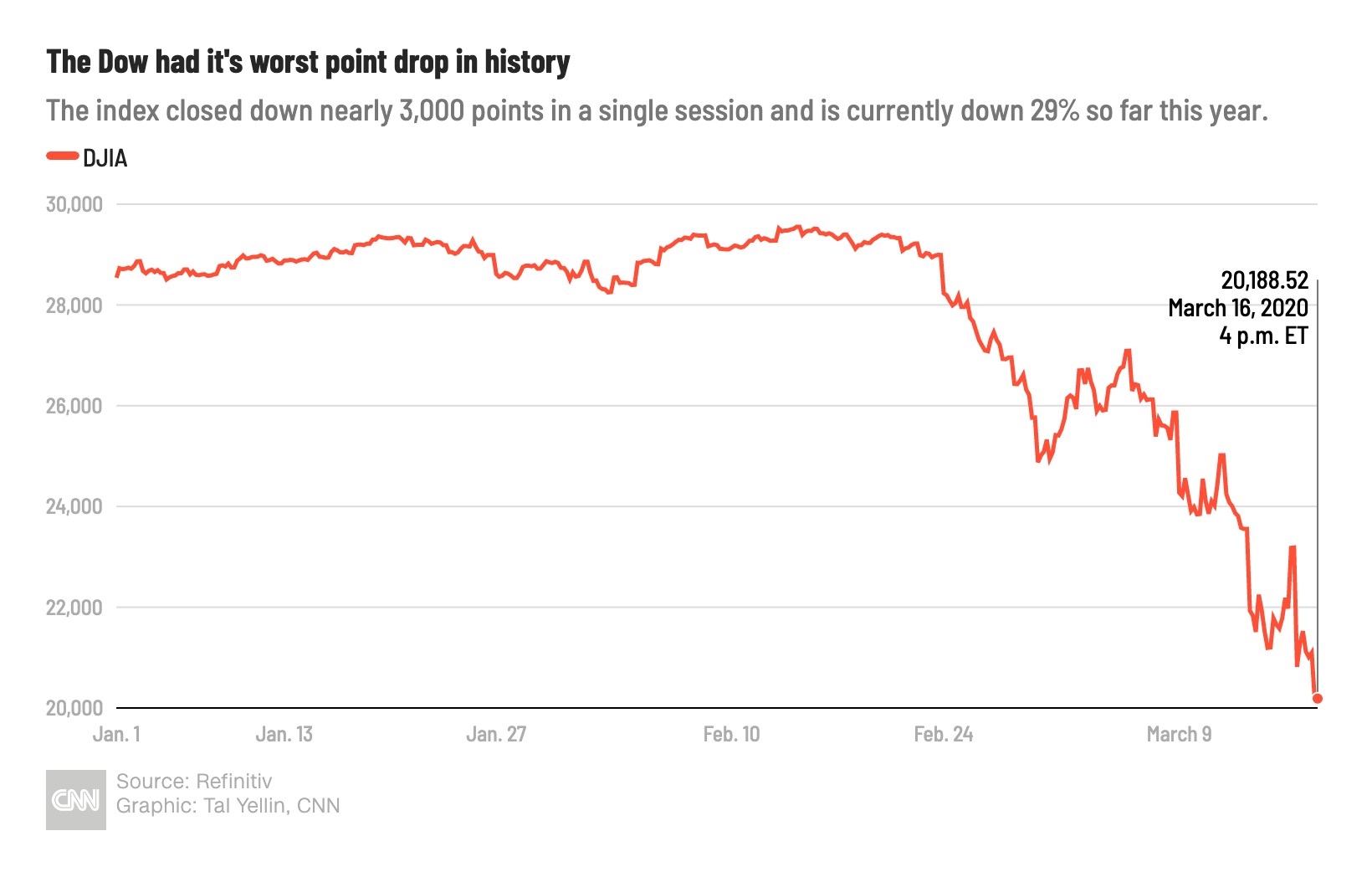

The Dow recorded its worst one-day point drop in history.The S&P 500 finished down nearly 12%. The Nasdaq Composite ended down 12.3%.CNN Business created a Coronavirus Markets Dashboard to help you track the stocks, sectors and indicators that are most affected by the pandemic.

32 Posts

SORT BYLatestOldest

11 min ago

Dow tumbles nearly 3,000 points -- worst point drop in history

From CNN Business' Anneken Tappe

It was another ugly day for US stocks. The Dow recorded its worst one-day point drop in history and its worst performance on a percentage basis since October 19, 1987, also known as “Black Monday.”

Stocks fell to session lows in the final hour of trading, as President Donald Trump said the outbreak could last until July or August. The Dow dropped more than 3,000 points at its worst.

The S&P 500 finished down nearly 12%.The Dow closed 2,997 points, or 12.9%, lower.The Nasdaq Composite ended down 12.3%.

49 min ago

Dow tumbles 2,700 points as Trump says this new normal could last until August

From CNN Business' David Goldman

The Dow was down 2,700 points after President Donald Trump said American life might not return to normal until August. It had fallen as many as 2,800 points Monday.

Trump also said the virus "is not under control" and acknowledged the economy may be falling into a recession.

Investors were displeased. The S&P 500 was down 10.8%.

DOS_patos

Unverified Legion of Trill member

so you coming thru the game or what?

StringerBell

OG

Sion

Legion of Trill

This is BS, the US GDP growth for 2019 was 2.1% they haven't even posted US GDP growth for this quarter yet. They wouldn't know truthfully until end of June. Unless GDP groth for Q1 declines sharply to something exorbitant.

The article is also speculating. Title is click bait. Make no mistake I would love one for the prices it would create on stock markets all over.

@Mr.LV You might be right with this my bad