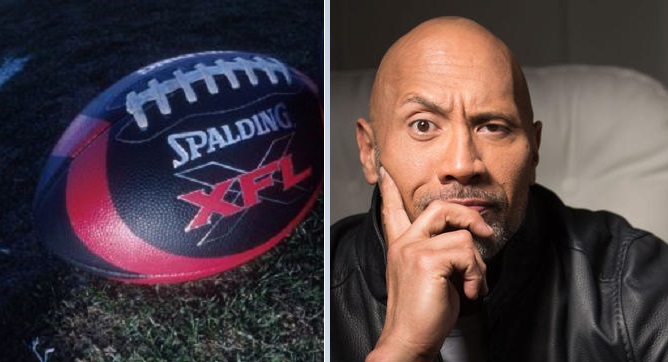

The Official Committee of Unsecured Creditors for Alpha Entertainment, the parent company of the XFL, filed a motion yesterday afternoon seeking to stop the sale of the XFL's assets to Alpha Acquico LLC, the group led by Dwayne "The Rock" Johnson, which was announced this morning.

As PWInsider.com reported yesterday, The XFL purchase for Alpha Acquico, for $15 million, brings them all of the XFL assets. They also agreed to take on "certain specified liabilities" and finance $8.5 million towards any payments that are needed to cure previous financial defaults from the old owner.

However, in a 13-page motion filed yesterday the XFL's unsecured creditors asked the court to pause the sale citing that Alpha Entertainment, "has an ongoing obligation to negotiate terms with the Proposed Buyer that are most favorable to the estate and do not unduly prejudice its creditors. The proposed APA, however, does not reflect such terms and seeks to strip the estate of valuable assets for no consideration. As such, the Committee has significant concerns that the Sale contemplated with the Proposed Buyer does not satisfy the sound business purpose test, and is not in the best interests of the Debtor’s estate."

The motion claims that Alpha Entertainment has "failed to value significant assets that are now being included in the Sale, but were not contemplated as part of the assets to be purchased in the form asset purchase agreement prepared" by Alpha Entertainment. In short, the creditors are concerned the XFL assets are being sold at a lesser value than they are worth and that the creditors could end up receiving nothing or very little from the sale - and that there are assets included in the sale that were not part of the financial evaluation of Alpha Entertainment when it filed for bankruptcy.

The motion notes that while they "generally" support the sale to The Rock's LLC, they want the sale to be re-worked so that the terms are better for the creditors who are owed money. The filing noted:

"This Objection is filed to preserve the Committee’s right to submit these issues to the Court, including objections for the form of Sale Order, for adjudication if they cannot be resolved prior to the Sale Hearing. In the interim, the Committee will continue to engage in good faith negotiations with the Debtor [Mike: XFL] and Proposed Buyer [Mike: Rock's LLC] regarding the objections raised herein in an effort to resolve the issues consensually."

The motion also noted they are concerned about decisions made about a quick sale resolving "a limited subset of potential claims" while noting "Committee is at a loss with respect to claims that the Debtor may have against insiders. As noted above and in other filings with this Court, the Committee has identified substantial potential causes of action against insiders, including millions of dollars in payments made within the 1-year insider preference period, questionable loan transactions within the days and weeks leading up to the bankruptcy and questionable actions and decisions made by certain insiders of the Debtor. These claims may have very real value to the Debtor’s estate—and to the unsecured creditors that were prejudiced by the insider conduct prior to the filing of this case and that will be further impaired if the Sale includes the insider claims—and, if retained by the estate, could form a significant source of recovery for the Debtor’s many aggrieved creditors."

The court, obviously, has not ruled on any of this yet.