DOS_patos

Unverified Legion of Trill member

You may have read or heard that Albert Einstein said, "The power of compound interest the most powerful force in the universe." Whether this is true or simply an important quote attributed to a great mind to give it more weight, compound interest is indeed remarkable, and you should use it to your advantage whenever possible.

When it comes to managing your money, generally the more risk you're willing to accept, the higher your potential returns. Historically, over the long term, putting money into stocks gives you a lot more return on your investment than putting it into a savings account (or stuffing it under the mattress).

After the recession that began in 2008, many people became risk-averse, and some decided to settle for lower returns in order to decrease risk. The problem is, putting all your money in an ordinary savings account may keep it safe, but the returns may not even keep up with inflation. While you should have a savings account for emergencies, putting some of your money in higher-risk investments has the potential for helping your long term financial prospects much more.

Compounded Interest

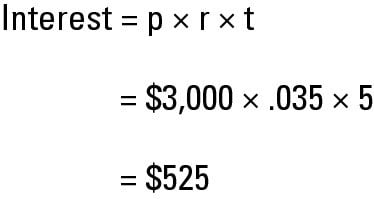

Here is a simple formula for calculating returns based on a flat interest rate that's compounded once per year:

Total return = Initial investment × (1 + i)^n

Where i = the interest rate and n = the number of years the money is invested

While this formula greatly oversimplifies compounding, since interest rates fluctuate and many savings vehicles compound more often than once per year, it can show how powerful compounding is.

As you can see, putting money into an ordinary savings account probably won't even let you outpace inflation, and that's before bank fees are taken into account. Compounding is great, but it's even greater when you "goose" it by adding to your savings every year.

Add Another $1,200 Each Year and Compounding Is More Impressive

Putting $1,200 in a savings account and forgetting about it for 40 years may keep it safe, but who knows how much $1,465 will be worth after that many years? Suppose that every year you save up $100 per month and then add that $1,200 to your savings. Results are pretty impressive:

Get Sound Financial Advice and Diversify

This is not to say you should put every spare dime into stocks, or just throw extra money at the stock market without doing your homework first. People have lost fortunes in the stock market, sometimes due to short-sighted investing, and sometimes due to factors beyond their control. This exercise is simply to show you that compounding is your friend when it comes to making money, and that if you're willing to accept higher risks, you may have substantially higher returns.

If you want to start investing, get your day-to-day finances in order first. Create a budget using great online tools like Mint, get three to six months' worth of living expenses in a savings account for emergencies, max out your IRA or 401K contributions, and generally make sure you and your family are on sound financial footing.

Don't start investing without learning about your choices beforehand. Many community classes offer basic courses in investing that can be well worth your time. Working with a certified financial planner is not just for the wealthy, but can be a very smart move for the middle class investor too. Just make sure to do your research first and choose carefully.

Once you start investing, you can use tools like Mint to help you track your investments. You can also learn more about your personal investment style, and use Mint to expose fees hidden on financial statements and in the fine print that reduce the long-term growth of your investments. Educate yourself, enlist in the advice of investing experts, and use Mint to track your budget and investments, and you set yourself up for the brightest financial future.

When it comes to managing your money, generally the more risk you're willing to accept, the higher your potential returns. Historically, over the long term, putting money into stocks gives you a lot more return on your investment than putting it into a savings account (or stuffing it under the mattress).

After the recession that began in 2008, many people became risk-averse, and some decided to settle for lower returns in order to decrease risk. The problem is, putting all your money in an ordinary savings account may keep it safe, but the returns may not even keep up with inflation. While you should have a savings account for emergencies, putting some of your money in higher-risk investments has the potential for helping your long term financial prospects much more.

Compounded Interest

Here is a simple formula for calculating returns based on a flat interest rate that's compounded once per year:

Total return = Initial investment × (1 + i)^n

Where i = the interest rate and n = the number of years the money is invested

While this formula greatly oversimplifies compounding, since interest rates fluctuate and many savings vehicles compound more often than once per year, it can show how powerful compounding is.

As you can see, putting money into an ordinary savings account probably won't even let you outpace inflation, and that's before bank fees are taken into account. Compounding is great, but it's even greater when you "goose" it by adding to your savings every year.

Add Another $1,200 Each Year and Compounding Is More Impressive

Putting $1,200 in a savings account and forgetting about it for 40 years may keep it safe, but who knows how much $1,465 will be worth after that many years? Suppose that every year you save up $100 per month and then add that $1,200 to your savings. Results are pretty impressive:

Get Sound Financial Advice and Diversify

This is not to say you should put every spare dime into stocks, or just throw extra money at the stock market without doing your homework first. People have lost fortunes in the stock market, sometimes due to short-sighted investing, and sometimes due to factors beyond their control. This exercise is simply to show you that compounding is your friend when it comes to making money, and that if you're willing to accept higher risks, you may have substantially higher returns.

If you want to start investing, get your day-to-day finances in order first. Create a budget using great online tools like Mint, get three to six months' worth of living expenses in a savings account for emergencies, max out your IRA or 401K contributions, and generally make sure you and your family are on sound financial footing.

Don't start investing without learning about your choices beforehand. Many community classes offer basic courses in investing that can be well worth your time. Working with a certified financial planner is not just for the wealthy, but can be a very smart move for the middle class investor too. Just make sure to do your research first and choose carefully.

Once you start investing, you can use tools like Mint to help you track your investments. You can also learn more about your personal investment style, and use Mint to expose fees hidden on financial statements and in the fine print that reduce the long-term growth of your investments. Educate yourself, enlist in the advice of investing experts, and use Mint to track your budget and investments, and you set yourself up for the brightest financial future.