You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How the Rich avoid paying taxes

- Thread starter Mr.LV

- Start date

The Lonious Monk

Celestial Souljah

Good video. I always knew there was a problem, but I never really understood how it worked.

It seems like that capital gains tax increase is something that should happen right now. Even if the corporate democrats didn't want to rock the boat, the could at least make it equal to the income tax.

It seems like that capital gains tax increase is something that should happen right now. Even if the corporate democrats didn't want to rock the boat, the could at least make it equal to the income tax.

Mr.LV

OG

This is wealthy

www.propublica.org

www.propublica.org

The Billionaire Playbook: How Sports Owners Use Their Teams to Avoid Millions in Taxes

Owners like Steve Ballmer can take the kinds of deductions on team assets — everything from media deals to player contracts — that industrialists take on factory equipment. That helps them pay lower tax rates than players and even stadium workers.

At a concession stand at Staples Center in Los Angeles, Adelaide Avila was pingponging between pouring beers, wiping down counters and taking out the trash. Her Los Angeles Lakers were playing their hometown rival, the Clippers, but Avila was working too hard to follow the March 2019 game.

When she filed taxes for her previous year’s labors at the arena and her second job driving for Uber, the 50-year-old Avila reported making $44,810. The federal government took a 14.1% cut.

by Robert Faturechi, Justin Elliott and Ellis SimaniJuly 8, 5 a.m. EDT

REPUBLISH

Series:The Secret IRS Files

Inside the Tax Records of the .001%

ProPublica is a nonprofit newsroom that investigates abuses of power. The Secret IRS Files is an ongoing reporting project.

Eight Takeaways From ProPublica’s Investigation of How Sports Owners Use Their Teams to Avoid Taxes

On the court that night, the players were also hard at work. None more so than LeBron James. The Lakers star was suffering through a painful strained groin injury, but he still put up more points and played more minutes than any other player.

In his tax return, James reported making $124 million in 2018. He paid a federal income tax rate of 35.9%. Not surprisingly, it was more than double the rate paid by Avila.

The wealthiest person in the building that night, in all likelihood, was Steve Ballmer, owner of the Clippers. The evening was decidedly less arduous for the billionaire former CEO of Microsoft. He sat courtside, in a pink dress shirt and slacks, surrounded by friends. His legs were outstretched, his shoes almost touching the sideline.

Ballmer had reason to smile: His Clippers won. But even if they hadn’t, his ownership of the team was reaping him massive tax benefits.

For the prior year, Ballmer reported making $656 million. The dollar figure he paid in taxes was large, $78 million; but as a percentage of what he made, it was tiny. Records reviewed by ProPublica show his federal income tax rate was just 12%.

That’s a third of the rate James paid, even though Ballmer made five times as much as the superstar player. Ballmer’s rate was also lower than Avila’s — even though Ballmer’s income was almost 15,000 times greater than the concession worker’s.

Ballmer pays such a low rate, in part, because of a provision of the U.S. tax code. When someone buys a business, they’re often able to deduct almost the entire sale price against their income during the ensuing years. That allows them to pay less in taxes. The underlying logic is that the purchase price was composed of assets — buildings, equipment, patents and more — that degrade over time and should be counted as expenses.

But in few industries is that tax treatment more detached from economic reality than in professional sports. Teams’ most valuable assets, such as TV deals and player contracts, are virtually guaranteed to regenerate because sports franchises are essentially monopolies. There’s little risk that players will stop playing for Ballmer’s Clippers or that TV stations will stop airing their games. But Ballmer still gets to deduct the value of those assets over time, almost $2 billion in all, from his taxable income.

This allows Ballmer to perform a kind of financial magic trick. If he profits from the Clippers, he can — legally — inform the IRS that he is losing money, thus saving vast sums on his taxes. If the Clippers are unprofitable in a given year, he can tell the IRS he’s losing vastly more.

Glimpses of the Clippers’ real-world financial results show the business has often been profitable. Those include audited financials disclosed in a Bank of America report just before Ballmer bought the team, as well as NBA records that were leaked after he became owner.

But IRS records obtained by ProPublica show the Clippers have reported $700 million in losses for tax purposes in recent years. Not only does Ballmer not have to pay tax on any real-world Clippers profits, he can use the tax write-off to offset his other income.

How a Billionaire Team Owner Pays a Lower Tax Rate Than LeBron James — and Stadium Workers, Too

A massive tax break allows owners to report huge losses to the IRS, even if their teams are profitable, and save themselves hundreds of millions.

The Billionaire Playbook: How Sports Owners Use Their Teams to Avoid Millions in Taxes

Owners like Steve Ballmer can take the kinds of deductions on team assets — everything from media deals to player contracts — that industrialists take on factory equipment. That helps them pay lower tax rates than players and even stadium workers.

The Billionaire Playbook: How Sports Owners Use Their Teams to Avoid Millions in Taxes

Owners like Steve Ballmer can take the kinds of deductions on team assets — everything from media deals to player contracts — that industrialists take on factory equipment. That helps them pay lower tax rates than players and even stadium workers.

At a concession stand at Staples Center in Los Angeles, Adelaide Avila was pingponging between pouring beers, wiping down counters and taking out the trash. Her Los Angeles Lakers were playing their hometown rival, the Clippers, but Avila was working too hard to follow the March 2019 game.

When she filed taxes for her previous year’s labors at the arena and her second job driving for Uber, the 50-year-old Avila reported making $44,810. The federal government took a 14.1% cut.

by Robert Faturechi, Justin Elliott and Ellis SimaniJuly 8, 5 a.m. EDT

REPUBLISH

Series:The Secret IRS Files

Inside the Tax Records of the .001%

ProPublica is a nonprofit newsroom that investigates abuses of power. The Secret IRS Files is an ongoing reporting project.

Eight Takeaways From ProPublica’s Investigation of How Sports Owners Use Their Teams to Avoid Taxes

On the court that night, the players were also hard at work. None more so than LeBron James. The Lakers star was suffering through a painful strained groin injury, but he still put up more points and played more minutes than any other player.

In his tax return, James reported making $124 million in 2018. He paid a federal income tax rate of 35.9%. Not surprisingly, it was more than double the rate paid by Avila.

The wealthiest person in the building that night, in all likelihood, was Steve Ballmer, owner of the Clippers. The evening was decidedly less arduous for the billionaire former CEO of Microsoft. He sat courtside, in a pink dress shirt and slacks, surrounded by friends. His legs were outstretched, his shoes almost touching the sideline.

Ballmer had reason to smile: His Clippers won. But even if they hadn’t, his ownership of the team was reaping him massive tax benefits.

For the prior year, Ballmer reported making $656 million. The dollar figure he paid in taxes was large, $78 million; but as a percentage of what he made, it was tiny. Records reviewed by ProPublica show his federal income tax rate was just 12%.

That’s a third of the rate James paid, even though Ballmer made five times as much as the superstar player. Ballmer’s rate was also lower than Avila’s — even though Ballmer’s income was almost 15,000 times greater than the concession worker’s.

Ballmer pays such a low rate, in part, because of a provision of the U.S. tax code. When someone buys a business, they’re often able to deduct almost the entire sale price against their income during the ensuing years. That allows them to pay less in taxes. The underlying logic is that the purchase price was composed of assets — buildings, equipment, patents and more — that degrade over time and should be counted as expenses.

But in few industries is that tax treatment more detached from economic reality than in professional sports. Teams’ most valuable assets, such as TV deals and player contracts, are virtually guaranteed to regenerate because sports franchises are essentially monopolies. There’s little risk that players will stop playing for Ballmer’s Clippers or that TV stations will stop airing their games. But Ballmer still gets to deduct the value of those assets over time, almost $2 billion in all, from his taxable income.

This allows Ballmer to perform a kind of financial magic trick. If he profits from the Clippers, he can — legally — inform the IRS that he is losing money, thus saving vast sums on his taxes. If the Clippers are unprofitable in a given year, he can tell the IRS he’s losing vastly more.

Glimpses of the Clippers’ real-world financial results show the business has often been profitable. Those include audited financials disclosed in a Bank of America report just before Ballmer bought the team, as well as NBA records that were leaked after he became owner.

But IRS records obtained by ProPublica show the Clippers have reported $700 million in losses for tax purposes in recent years. Not only does Ballmer not have to pay tax on any real-world Clippers profits, he can use the tax write-off to offset his other income.

How a Billionaire Team Owner Pays a Lower Tax Rate Than LeBron James — and Stadium Workers, Too

A massive tax break allows owners to report huge losses to the IRS, even if their teams are profitable, and save themselves hundreds of millions.

Last edited:

The Lonious Monk

Celestial Souljah

America taxes income not wealth

True, but as the video pointed out, rich people get income through capital gains and for some reason those are taxed at a lower rate than earned income.

Mr.LV

OG

Continue

Ballmer isn’t alone. ProPublica reviewed tax information for dozens of team owners across the four largest American pro sports leagues. Owners frequently report incomes for their teams that are millions below their real-world earnings, according to the tax records, previously leaked team financial records and interviews with experts.

They include Shahid Khan, an automotive tycoon who made use of at least $79 million in losses from a stake in the Jacksonville Jaguars even as his football team has consistently been projected to bring in millions a year. And Leonard Wilf, a New Jersey real estate developer who owns the Minnesota Vikings with family members, has taken $66 million in losses from his minority stake in the team.

In a statement, Khan responded: “We’re a nation of laws. U.S. Congress passes them. In the case of tax laws, the IRS applies and enforces the regulations, which are absolute. We simply and fully comply with those very IRS regulations.” Wilf didn’t respond to questions.

Ballmer’s spokesperson declined to answer specific questions, but said “Steve has always paid the taxes he owes, and has publicly noted that he would personally be fine with paying more.”

These revelations are part of what ProPublica has unearthed in a trove of tax information for the wealthiest Americans. ProPublica has already revealed that billionaires are paying shockingly little to the government by avoiding the types of income that can be taxed.

The records also show how some of the richest people on the planet use their membership in the exclusive club of pro sports team owners to further lower their tax bills.

The records upend conventional wisdom about how taxation works in America. Billionaire owners are consistently paying lower tax rates than their millionaire players — and often lower even than the rates paid by the workers who staff their stadiums. The massive reductions on personal tax bills that owners glean from their teams come on top of the much-criticized subsidies the teams get from local governments for new stadiums and further deplete federal coffers that fund everything from the military to medical research to food stamps and other safety net programs.

Ultrawealthy Sports Owners Often Pay a Substantially Lower Income Tax Rate Than Athletes

A review of federal tax records from 2017 and 2018 shows that the tax code favors team owners over wage-earning athletes. Here are some prominent

“Mr. DeVos complies with all federal, state and local tax laws and pays his obligations in full,” a spokesperson for Daniel DeVos said in a statement, adding, “I don’t intend to comment on the accuracy or inaccuracy of any data obtained illegally.” Representatives for Philip Anschutz, Anthony Davis, Josh Harris and LeBron James declined to comment. Representatives for Stan Kroenke, Justin Verlander and Tiger Woods did not respond to inquiries by ProPublica. A representative for John Henry declined to receive questions about his taxes. Floyd Mayweather’s tax lawyer, Jeffrey Morse, declined to comment about the boxer’s tax numbers, but in response to questions about the fairness of athletes paying higher rates than owners, he said, “It is a discussion worth having.”

Figures above reflect adjusted gross income for 2017 and 2018 added together. The tax rates were calculated using the total federal income taxes paid during those two years, including both the employees’ and employers’ share of payroll taxes. Credit:Lucas Waldron/ProPublica

The history of team ownership as a way to avoid taxes goes back almost a century. Bill Veeck, owner of the Cleveland Indians in the 1940s and later the Chicago White Sox, stated it plainly in his memoir: “Look, we play the Star Spangled Banner before every game. You want us to pay income taxes too?”

Veeck is credited with convincing the IRS to accept a tax maneuver even he described as a “gimmick.” Player salaries were already treated as a deductible business expense for a team. That was not controversial in the slightest.

But Veeck dreamed up an innovation, a way to get a second tax deduction for the same players: depreciation. The way he accomplished this was by separately buying the contracts before the old company was liquidated, instead of transferring them to the new company as had been done before. That meant that the contracts were treated as a separate asset. The value a new owner assigned to that asset when he bought the team could be used to offset taxes on team profits, as well as any other income he might have. (Defenders of the practice contend that it’s not double-dipping since the deductions are taken against two separate pools of money: the money used to purchase the team and the day-to-day operating budget.)

Team owners, Veeck wrote in his memoir, had won “a tax write-off that could have been figured out by a Texas oilman. It wasn’t figured out by a Texas oilman. It was figured out by a Chicago hustler. Me.”

Once the IRS accepted this premise, the natural next step — owners assigning as large a portion of the total team purchase price as possible to player contracts — was elevated into a sport of its own. Decades ago, Paul Beeston, who was president of the Toronto Blue Jays and president of Major League Baseball at various times, famously described the result: “Under generally accepted accounting principles, I could turn a $4 million profit into a $2 million loss and I could get every national accounting firm to agree with me.”

The depreciation of tangible assets, and their decay over time, is often intuitive. A machine in a factory and a fleet of cars have more obvious fair market values and life spans before business owners will have to pay to replace them. Take, for example, a newspaper business with a printing press that cost $10 million and will last for, say, 20 years. The idea of depreciation is that the newspaper owner could deduct a piece of that $10 million every year for the 20-year lifespan of the press.

But amortization, the term for depreciating nonphysical assets, was less straightforward. Sports teams are often mainly composed of these assets. Valuing and assigning a life span to a player contract or a TV deal was more subjective and thus vulnerable to aggressive tax maneuvers by team owners.

Several NBA teams claimed that more than 90% — in one case, 100% — of their value consisted of player contracts that could be written off on the owner’s taxes, according to league financials that emerged in an early 1970s congressional investigation.

By that time the IRS had begun a series of challenges of valuation methods by team owners, part of a larger fight across industries about how business owners should be allowed to write off so-called intangible assets. The tax agency insisted that companies should only be able to write off assets with a limited useful life.

In an effort to stop the endless litigation, Congress inaugurated the modern era of amortization by simplifying the rules in 1993: Under the new regime, the purchaser of a business would be allowed, over the span of 15 years, to write off more types of intangible assets. This might have been welcome news for the sports business. But Congress explicitly excluded the industry from the law.

Following lobbying by Major League Baseball, in 2004, sports teams were granted the right to use this deduction as part of a tax bill signed by President George W. Bush, himself a former part owner of the Texas Rangers. Now, team owners could write off the price they paid not just for player contracts, but also a range of other items such as TV and radio contracts and even goodwill, an amorphous accounting concept that represents the value of a business’ reputation. Altogether, those assets typically amount to 90% or more of the price paid for a team.

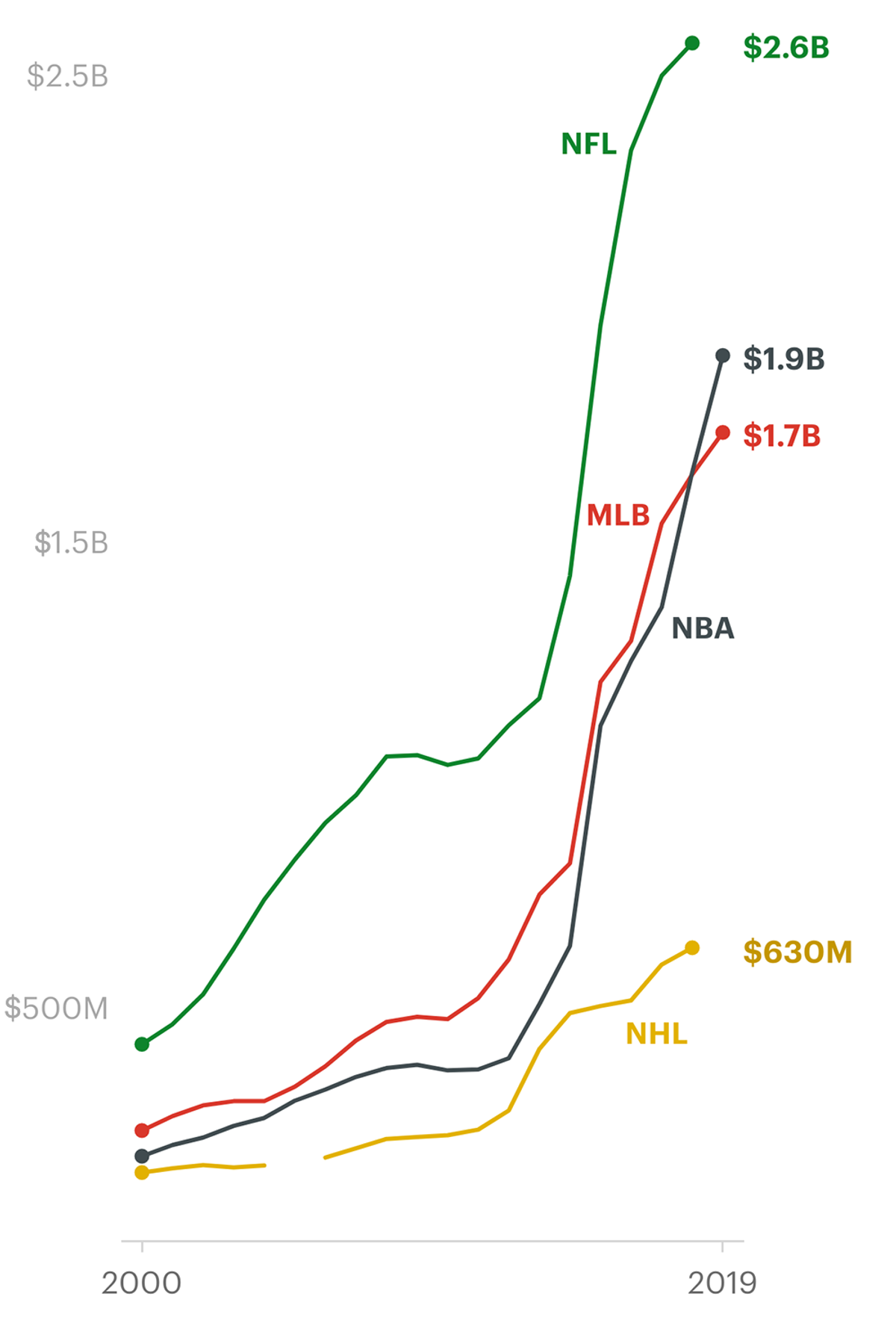

That means when billionaires buy teams, the law allows them to treat almost all of what they bought, including assets that don’t lose value, as deteriorating over time. A team’s franchise rights, which never expire, automatically get treated like a pharmaceutical company’s patent on a blockbuster drug, which has a finite life span. In reality, the right to operate a franchise in one of the major leagues has in the last few decades been a license to print money: In the past two decades, the average value of basketball, football, baseball and hockey teams has grown by more than 500%.

ProPublica uncovered the tax breaks used by team owners by dissecting reports sent to the IRS that capture the profit or loss of a business. Still, untangling the precise benefits can be difficult. For example, some owners hold their team stakes in companies that also had unrelated assets — a corporate nesting doll that makes it impossible to determine the losses a team produced. The examples mentioned in this article are instances in which it appears the owners did not intermingle assets and the team’s ownership structure is clear based on ProPublica’s analysis of the tax records, court documents, corporate registration data and news reports.

Ballmer isn’t alone. ProPublica reviewed tax information for dozens of team owners across the four largest American pro sports leagues. Owners frequently report incomes for their teams that are millions below their real-world earnings, according to the tax records, previously leaked team financial records and interviews with experts.

They include Shahid Khan, an automotive tycoon who made use of at least $79 million in losses from a stake in the Jacksonville Jaguars even as his football team has consistently been projected to bring in millions a year. And Leonard Wilf, a New Jersey real estate developer who owns the Minnesota Vikings with family members, has taken $66 million in losses from his minority stake in the team.

In a statement, Khan responded: “We’re a nation of laws. U.S. Congress passes them. In the case of tax laws, the IRS applies and enforces the regulations, which are absolute. We simply and fully comply with those very IRS regulations.” Wilf didn’t respond to questions.

Ballmer’s spokesperson declined to answer specific questions, but said “Steve has always paid the taxes he owes, and has publicly noted that he would personally be fine with paying more.”

These revelations are part of what ProPublica has unearthed in a trove of tax information for the wealthiest Americans. ProPublica has already revealed that billionaires are paying shockingly little to the government by avoiding the types of income that can be taxed.

The records also show how some of the richest people on the planet use their membership in the exclusive club of pro sports team owners to further lower their tax bills.

The records upend conventional wisdom about how taxation works in America. Billionaire owners are consistently paying lower tax rates than their millionaire players — and often lower even than the rates paid by the workers who staff their stadiums. The massive reductions on personal tax bills that owners glean from their teams come on top of the much-criticized subsidies the teams get from local governments for new stadiums and further deplete federal coffers that fund everything from the military to medical research to food stamps and other safety net programs.

Ultrawealthy Sports Owners Often Pay a Substantially Lower Income Tax Rate Than Athletes

A review of federal tax records from 2017 and 2018 shows that the tax code favors team owners over wage-earning athletes. Here are some prominent

“Mr. DeVos complies with all federal, state and local tax laws and pays his obligations in full,” a spokesperson for Daniel DeVos said in a statement, adding, “I don’t intend to comment on the accuracy or inaccuracy of any data obtained illegally.” Representatives for Philip Anschutz, Anthony Davis, Josh Harris and LeBron James declined to comment. Representatives for Stan Kroenke, Justin Verlander and Tiger Woods did not respond to inquiries by ProPublica. A representative for John Henry declined to receive questions about his taxes. Floyd Mayweather’s tax lawyer, Jeffrey Morse, declined to comment about the boxer’s tax numbers, but in response to questions about the fairness of athletes paying higher rates than owners, he said, “It is a discussion worth having.”

Figures above reflect adjusted gross income for 2017 and 2018 added together. The tax rates were calculated using the total federal income taxes paid during those two years, including both the employees’ and employers’ share of payroll taxes. Credit:Lucas Waldron/ProPublica

The history of team ownership as a way to avoid taxes goes back almost a century. Bill Veeck, owner of the Cleveland Indians in the 1940s and later the Chicago White Sox, stated it plainly in his memoir: “Look, we play the Star Spangled Banner before every game. You want us to pay income taxes too?”

Veeck is credited with convincing the IRS to accept a tax maneuver even he described as a “gimmick.” Player salaries were already treated as a deductible business expense for a team. That was not controversial in the slightest.

But Veeck dreamed up an innovation, a way to get a second tax deduction for the same players: depreciation. The way he accomplished this was by separately buying the contracts before the old company was liquidated, instead of transferring them to the new company as had been done before. That meant that the contracts were treated as a separate asset. The value a new owner assigned to that asset when he bought the team could be used to offset taxes on team profits, as well as any other income he might have. (Defenders of the practice contend that it’s not double-dipping since the deductions are taken against two separate pools of money: the money used to purchase the team and the day-to-day operating budget.)

Team owners, Veeck wrote in his memoir, had won “a tax write-off that could have been figured out by a Texas oilman. It wasn’t figured out by a Texas oilman. It was figured out by a Chicago hustler. Me.”

Once the IRS accepted this premise, the natural next step — owners assigning as large a portion of the total team purchase price as possible to player contracts — was elevated into a sport of its own. Decades ago, Paul Beeston, who was president of the Toronto Blue Jays and president of Major League Baseball at various times, famously described the result: “Under generally accepted accounting principles, I could turn a $4 million profit into a $2 million loss and I could get every national accounting firm to agree with me.”

The depreciation of tangible assets, and their decay over time, is often intuitive. A machine in a factory and a fleet of cars have more obvious fair market values and life spans before business owners will have to pay to replace them. Take, for example, a newspaper business with a printing press that cost $10 million and will last for, say, 20 years. The idea of depreciation is that the newspaper owner could deduct a piece of that $10 million every year for the 20-year lifespan of the press.

But amortization, the term for depreciating nonphysical assets, was less straightforward. Sports teams are often mainly composed of these assets. Valuing and assigning a life span to a player contract or a TV deal was more subjective and thus vulnerable to aggressive tax maneuvers by team owners.

Several NBA teams claimed that more than 90% — in one case, 100% — of their value consisted of player contracts that could be written off on the owner’s taxes, according to league financials that emerged in an early 1970s congressional investigation.

By that time the IRS had begun a series of challenges of valuation methods by team owners, part of a larger fight across industries about how business owners should be allowed to write off so-called intangible assets. The tax agency insisted that companies should only be able to write off assets with a limited useful life.

In an effort to stop the endless litigation, Congress inaugurated the modern era of amortization by simplifying the rules in 1993: Under the new regime, the purchaser of a business would be allowed, over the span of 15 years, to write off more types of intangible assets. This might have been welcome news for the sports business. But Congress explicitly excluded the industry from the law.

Following lobbying by Major League Baseball, in 2004, sports teams were granted the right to use this deduction as part of a tax bill signed by President George W. Bush, himself a former part owner of the Texas Rangers. Now, team owners could write off the price they paid not just for player contracts, but also a range of other items such as TV and radio contracts and even goodwill, an amorphous accounting concept that represents the value of a business’ reputation. Altogether, those assets typically amount to 90% or more of the price paid for a team.

That means when billionaires buy teams, the law allows them to treat almost all of what they bought, including assets that don’t lose value, as deteriorating over time. A team’s franchise rights, which never expire, automatically get treated like a pharmaceutical company’s patent on a blockbuster drug, which has a finite life span. In reality, the right to operate a franchise in one of the major leagues has in the last few decades been a license to print money: In the past two decades, the average value of basketball, football, baseball and hockey teams has grown by more than 500%.

ProPublica uncovered the tax breaks used by team owners by dissecting reports sent to the IRS that capture the profit or loss of a business. Still, untangling the precise benefits can be difficult. For example, some owners hold their team stakes in companies that also had unrelated assets — a corporate nesting doll that makes it impossible to determine the losses a team produced. The examples mentioned in this article are instances in which it appears the owners did not intermingle assets and the team’s ownership structure is clear based on ProPublica’s analysis of the tax records, court documents, corporate registration data and news reports.

Mr.LV

OG

Continue

A nice graphic is a part of this section of the story Clicked the link to see it original post to see it.

When Steve Ballmer offered to buy the Clippers in 2014 for a record sum, the team’s longtime owner, Donald Sterling, was taken aback.

“I’m curious about one thing,” Sterling said at a meeting later recounted by his lawyer.

“Of course, what is the question?” Ballmer responded.

Sterling proceeded: “You really have $2 billion?”

The size of the offer was impressive considering the context. In 1981, Sterling had paid $12.5 million for the club. In the three decades that followed, Sterling had become notorious for neglecting and mistreating the team. He didn’t provide a training facility for years, forcing the team to practice at the gym of a local junior college. He heckled his own players during games. After games, Sterling was said to parade friends through the locker room so they could gawk at the players’ bodies.

But even Sterling’s mismanagement couldn’t stop the Clippers’ rise in value. Players kept signing with the Clippers — drafted rookies because they typically have no other option if they want to play in the NBA and veterans because there are a finite number of teams to choose from.

TV deals also grew in value. The Clippers had little fan support, and they oscillated between being league bottom-dwellers and a middling franchise. But before Sterling sold the team, the Clippers were expected to sign a new local media deal worth two to three times more than their previous deal.

The beginning of the end of Sterling’s tenure came when he was recorded by his mistress telling her not to bring Black people to Clippers games. The NBA moved to force Sterling out. Ballmer swooped in, outbidding Oprah Winfrey and others. (ProPublica couldn’t reach Sterling for comment. His wife, Shelly, who co-owned the Clippers with him, defended their tenure in emails to ProPublica, saying they weren’t the only owners whose team didn’t own a practice facility and suggesting her husband did not heckle players. “I GUESS WHEN THERE IS NOTHING TO WRITE ABOUT WHY NOT TRY TO WRITE SOME SCUM,” she wrote.)

Ballmer, one of the richest people in the world, wasn’t just motivated by his love for basketball. He expected the team to be profitable. “It’s not a cheap price, but when you’re used to looking at tech companies with huge risk, no earnings and huge multiples, this doesn’t look like the craziest thing I’ve ever acquired,” he said at the time. “There’s much less risk. There’s real earnings in this business.”

Two years later, as the league negotiated a new contract with the players union, Ballmer portrayed the team’s finances in a much different light. “I’m a new owner and I’ve heard this is the golden age of basketball economics. You should tell our finance people that,” he told a reporter in 2016. “We’re sitting there looking at red ink, and it’s real red ink. I know, it shows up on my tax returns.”

But losses on a tax return don’t necessarily mean losses, as large or at all, in the real world.

Ballmer was acquiring a team that had skyrocketed in value over the previous decade. And there was the benefit for his taxes: He was allowed to start treating the Clippers — including those player contracts and TV deals — as if they were losing value.

From 2014 to 2018, records show Ballmer reported a total of $700 million in losses from his ownership of the Clippers, almost certainly composed mainly of paper losses from amortization.

A nice graphic is a part of this section of the story Clicked the link to see it original post to see it.

When Steve Ballmer offered to buy the Clippers in 2014 for a record sum, the team’s longtime owner, Donald Sterling, was taken aback.

“I’m curious about one thing,” Sterling said at a meeting later recounted by his lawyer.

“Of course, what is the question?” Ballmer responded.

Sterling proceeded: “You really have $2 billion?”

The size of the offer was impressive considering the context. In 1981, Sterling had paid $12.5 million for the club. In the three decades that followed, Sterling had become notorious for neglecting and mistreating the team. He didn’t provide a training facility for years, forcing the team to practice at the gym of a local junior college. He heckled his own players during games. After games, Sterling was said to parade friends through the locker room so they could gawk at the players’ bodies.

But even Sterling’s mismanagement couldn’t stop the Clippers’ rise in value. Players kept signing with the Clippers — drafted rookies because they typically have no other option if they want to play in the NBA and veterans because there are a finite number of teams to choose from.

TV deals also grew in value. The Clippers had little fan support, and they oscillated between being league bottom-dwellers and a middling franchise. But before Sterling sold the team, the Clippers were expected to sign a new local media deal worth two to three times more than their previous deal.

The beginning of the end of Sterling’s tenure came when he was recorded by his mistress telling her not to bring Black people to Clippers games. The NBA moved to force Sterling out. Ballmer swooped in, outbidding Oprah Winfrey and others. (ProPublica couldn’t reach Sterling for comment. His wife, Shelly, who co-owned the Clippers with him, defended their tenure in emails to ProPublica, saying they weren’t the only owners whose team didn’t own a practice facility and suggesting her husband did not heckle players. “I GUESS WHEN THERE IS NOTHING TO WRITE ABOUT WHY NOT TRY TO WRITE SOME SCUM,” she wrote.)

Ballmer, one of the richest people in the world, wasn’t just motivated by his love for basketball. He expected the team to be profitable. “It’s not a cheap price, but when you’re used to looking at tech companies with huge risk, no earnings and huge multiples, this doesn’t look like the craziest thing I’ve ever acquired,” he said at the time. “There’s much less risk. There’s real earnings in this business.”

Two years later, as the league negotiated a new contract with the players union, Ballmer portrayed the team’s finances in a much different light. “I’m a new owner and I’ve heard this is the golden age of basketball economics. You should tell our finance people that,” he told a reporter in 2016. “We’re sitting there looking at red ink, and it’s real red ink. I know, it shows up on my tax returns.”

But losses on a tax return don’t necessarily mean losses, as large or at all, in the real world.

Ballmer was acquiring a team that had skyrocketed in value over the previous decade. And there was the benefit for his taxes: He was allowed to start treating the Clippers — including those player contracts and TV deals — as if they were losing value.

From 2014 to 2018, records show Ballmer reported a total of $700 million in losses from his ownership of the Clippers, almost certainly composed mainly of paper losses from amortization.

Mr.LV

OG

The evidence examined by ProPublica showed the Clippers have often been profitable, though many of the glimpses into the team’s finances are from before Ballmer took over. Leaked NBA records during Ballmer’s tenure showed the Clippers in the black as recently as 2017. Audited financials disclosed in the Bank of America report just before the sale showed the team netting $14 million and $18 million in the two years before Ballmer took over, with projected growth in the future. Tax records for the pre-Ballmer era examined by ProPublica showed the team consistently making millions in profits. Forbes has also estimated the team generates millions in annual profits.

Nevertheless, Ballmer reported staggering losses from the Clippers to the IRS. Those losses allowed him to reduce the taxes he owed on the billions he has reaped from Microsoft stock sales and dividends. Owning the Clippers cut his tax bill by about $140 million in just five years, according to a ProPublica analysis.

Team Values Across Professional Sports Leagues Have Increased for the Past 20 Years

On average, major sports franchises have consistently increased in value over the past two decades, according to estimates by Forbes.

Nevertheless, Ballmer reported staggering losses from the Clippers to the IRS. Those losses allowed him to reduce the taxes he owed on the billions he has reaped from Microsoft stock sales and dividends. Owning the Clippers cut his tax bill by about $140 million in just five years, according to a ProPublica analysis.

Team Values Across Professional Sports Leagues Have Increased for the Past 20 Years

On average, major sports franchises have consistently increased in value over the past two decades, according to estimates by Forbes.

Olorun22

Active Member

Stop saying you going to do but the dont. I've been waiting for you to do it for a minute...been saying i was gonna make a tax thread for awhile .......every time i start.....im jut like..ehhhh whats the point.

DOS_patos

Unverified Legion of Trill member

My faultStop saying you going to do but the dont. I've been waiting for you to do it for a minute...

The Lonious Monk

Celestial Souljah

Which makes sense and that's better and you don't have to be rich to do that either.

No it doesn't make sense for investments to be taxed lower than the money people slave away to make. And no you don't have to be rich, but you do have to have disposable income which is increasingly rare for people who aren't rich.

Rainbowdildobuttmonkey

Active Member

So is this the same as putting LLC and property in trusts to pay lower taxes or nah?

Mr BFK

Active Member

No it doesn't make sense for investments to be taxed lower than the money people slave away to make. And no you don't have to be rich, but you do have to have disposable income which is increasingly rare for people who aren't rich.

great thread topic

but at the underlined I think the logic is that a lower capital gains tax rate encourages investment from the rich/wealthy

even if u own ur own company (like a massive Fortune 500 company) the govt believes it incentivizes u to worry about managing the well being of the corporation for the long haul..........ie. if u get paid in stock, then u worry about the company becuz u are worried about ur own personal wealth when u cash out stock every yr

but if u just take a cash salary, then at any point u could just say fuck the company and walk away at the expense of that company failing afterwards........encouraging a stock compensation model encourages the leadership of a company to have a continued vested interest

The Lonious Monk

Celestial Souljah

great thread topic

but at the underlined I think the logic is that a lower capital gains tax rate encourages investment from the rich/wealthy

even if u own ur own company (like a massive Fortune 500 company) the govt believes it incentivizes u to worry about managing the well being of the corporation for the long haul..........ie. if u get paid in stock, then u worry about the company becuz u are worried about ur own personal wealth when u cash out stock every yr

but if u just take a cash salary, then at any point u could just say fuck the company and walk away at the expense of that company failing afterwards........encouraging a stock compensation model encourages the leadership of a company to have a continued vested interest

Rich people would still invest with a higher tax. After all investing is how a lot of them got rich in the first place.

Mr BFK

Active Member

Rich people would still invest with a higher tax. After all investing is how a lot of them got rich in the first place.

not disagreeing with u there

it's just the lower tax rate does encourage investment.........even tho richer people would still invest at a higher tax rate

but it's the "new money" folks who would lose out the most if u raised the capital gains rate

The Lonious Monk

Celestial Souljah

not disagreeing with u there

it's just the lower tax rate does encourage investment.........even tho richer people would still invest at a higher tax rate

but it's the "new money" folks who would lose out the most if u raised the capital gains rate

Yeah, we might see fewer super wealthy people, but that's fine.